Buy Sell SuperTrend Version 2

$3,999.00 Original price was: $3,999.00.$250.00Current price is: $250.00.

If you want this indicator then you can pay crypto 239$ (Contact Admin) Click Here

- Original Indicator

- Trading time: Every time

- Instant Download in Zip file

- Working Timeframe: M1 to W1

- Use on Unlimited Tradingview Accounts

- Type of strategy: Scalping and Intraday

- Source Code:- Pine script

- Works on All pairs Forex, Crypto, Stock Marke etc.

- Customer Support & Free Upgrades

- Lifetime Version

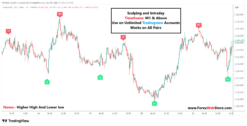

It looks like you’re asking about the Buy Sell SuperTrend Version 2 indicator shown in the image and how to use it for trading entries and exits. Here’s a breakdown of how this type of indicator typically works, based on the visual cues in the chart.

The “Buy Sell SuperTrend Version 2” is a trend-following indicator that provides clear entry and exit signals. green for an uptrend and red for a downtrend. A “BUY” signal is generated when the price crosses above the line, and the line turns green. A “SELL” signal is generated, and the line turns red. This visual tool helps traders quickly identify the dominant market direction and potential trading opportunities.

How to Use the Buy/Sell Indicator for Entries and Exits

The indicator is designed to give straightforward signals, making it easier to identify potential trend changes. Here’s a point-by-point guide on how to use it:

- Buy Signal (Entry): A buy signal appears when the indicator line turns green and a “BUY” label appears below the price. This suggests a potential uptrend is starting. An entry would typically be made at or shortly after this signal appears, as shown on the chart.

- Hold (During Uptrend): Once a buy signal is given, you would hold the position as long as the indicator line remains green and stays below the price candles. This green line acts as a dynamic support level.

- Sell Signal (Exit/Entry): A sell signal is generated when the indicator line turns red and a “SELL” label appears above the price. This suggests a potential downtrend is starting. You would typically exit your long (buy) position here. Alternatively, this can be an entry point for a short (sell) position if you are trading in a downtrend.

- Hold (During Downtrend): After a sell signal, you would hold your short position as long as the indicator line remains red and stays above the price candles. This red line acts as a dynamic resistance level.

- Second Buy Signal (Exit/Entry): If the trend reverses and a new buy signal appears, you would exit your short position and could consider entering a new long position.

In essence, the indicator uses a color-changing line and labels to signal trend direction. Green signals an uptrend, and red signals a downtrend. The most basic strategy is to follow these signals: buy on green, sell on red.

- Entry: Look for short-term entry, such as buy or sell, in the direction of the overall trend indicated by an Arrow indicator. This rule advises that trades should be taken in the same direction as the established long-term trend to increase the probability of success.

- Entry Confirmation: Enter trades when the Arrow confirms your signal, ensuring that risk-to-reward ratios are favorable. This emphasizes the need for a secondary confirmation from the indicator and the importance of a positive risk-to-reward ratio, where potential profit outweighs potential loss.

- Exit (Profit): Set tight profit targets (e.g., 15-20 pips) and adhere to them strictly. This rule outlines a disciplined approach to taking profits, recommending small, fixed targets, which is a common characteristic of scalping or short-term trading strategies.

- Exit (Risk Management): Also, use stop-loss orders to manage risk and protect capital. Consider trailing stops to lock in profits as the trade moves in your favor. This highlights the crucial role of risk management through the use of stop-loss orders to limit losses and trailing stops to secure profits on winning trades.

2 reviews for Buy Sell SuperTrend Version 2

Add a review Cancel reply

You must be logged in to post a review.

Related products

-77%

Tradingview

-84%

Tradingview

-91%

Tradingview

Rated 4.67 out of 5

-94%

Tradingview

Rated 4.5 out of 5

-85%

Tradingview

-94%

Tradingview

-94%

Tradingview

-82%

Tradingview

Rated 4.5 out of 5

joe andrade –

I love using their indicators and jump for joy when they have sales. The customer service is very helpful and I highly recommend their indicators. I l use the trend focus indicator daily along with the Trend indicator. I also just purchased the Red green line indicator and looking to combine it with the better trend indicator.Class act indicators that work very well.

James McCombs –

Over the past few months I think ive bought at least 10 indicators or close to it. I’ve had nothing but great experiences. They have the best deals including this past Black Friday sale. 4 for 1 indicators. Definitely support. I can’t swing the money for the bad indicator but I’m satisfied with what I already have! Customer service is great as well! Thanks for an amazing experience!