Range Filter Short Long Indicator

$1,500.00 Original price was: $1,500.00.$350.00Current price is: $350.00.

If you want this indicator then you can pay crypto 239$ (Contact Admin) Click Here

- Original Indicator

- Trading time: Every time

- Instant Download in Zip file

- Working Timeframe: M1 to W1

- Use on Unlimited Tradingview Accounts

- Type of strategy: Scalping and Intraday

- Source Code:- Pine script

- Works on All pairs Forex, Crypto, Stock Marke etc.

- Customer Support & Free Upgrades

- Lifetime Version

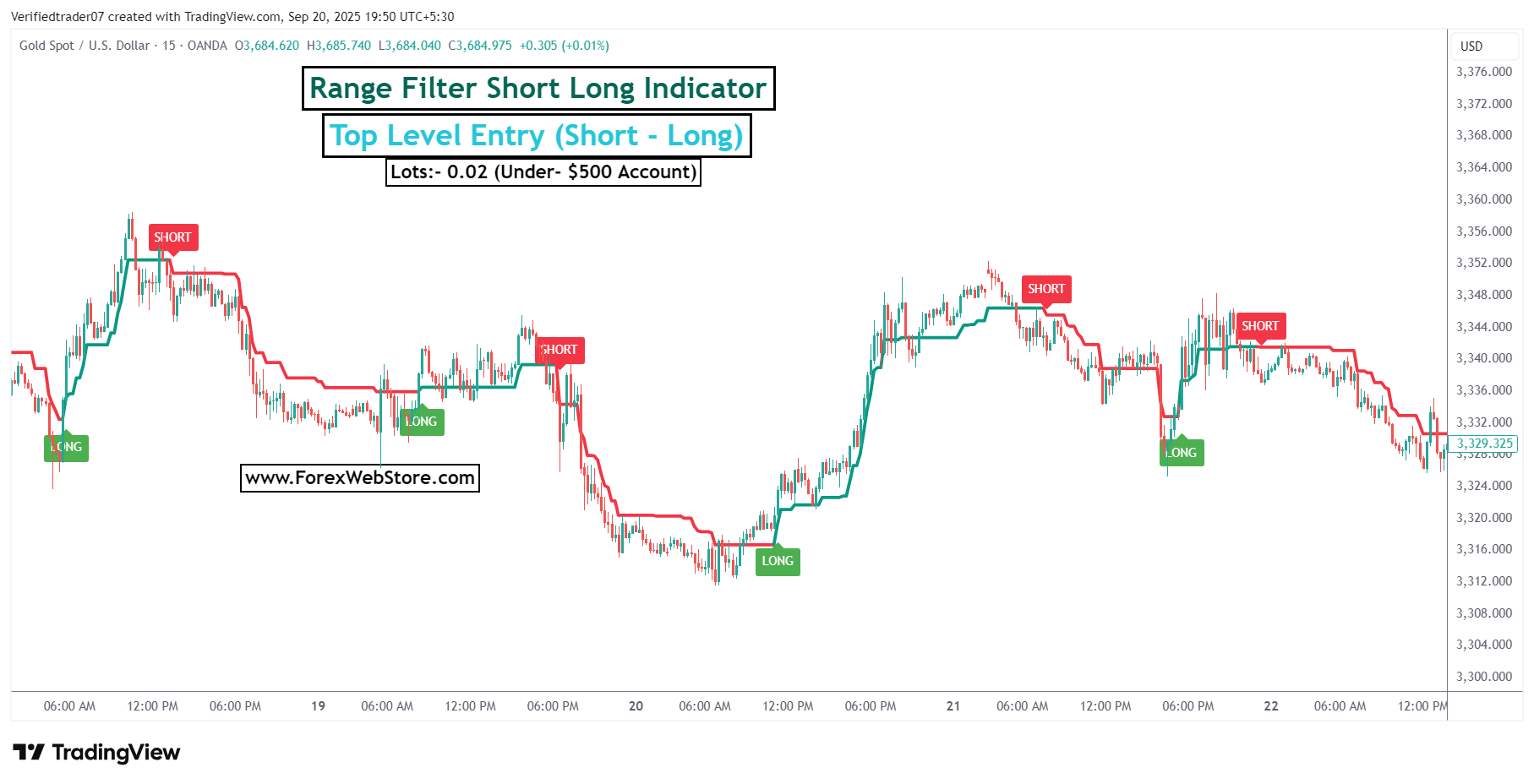

Based on the image you’ve uploaded, here is a breakdown of how to use this trading indicator for buy and sell signals, as well as where to consider placing your stop loss and take profit.

How the Indicator Works

The image shows a trading chart for Gold Spot (XAUUSD) with an indicator named “Range Filter Short Long.” This tool is designed to identify the trend and give you signals for entries.

- Green Line/Area: Indicates an uptrend. When the line turns green and you see a “LONG” signal, it’s suggesting a potential buy entry.

- Red Line/Area: Indicates a downtrend. When the line turns red and you see a “SHORT” signal, it’s suggesting a potential sell entry.

The key idea is to follow the color changes: go long when it turns green, and go short when it turns red.

Buy and Sell Entries

- Buy Entry: Enter a buy trade when the indicator line turns green and a “LONG” label appears.

- Sell Entry: Enter a sell trade when the indicator line turns red and a “SHORT” label appears.

Stop Loss and Take Profit

The indicator itself doesn’t provide explicit stop loss or take profit levels, but traders commonly use its lines and signals to manage their risk.

- Stop Loss (for a Buy Trade): A good strategy is to place your stop loss just below the green support line. This line acts as a dynamic support level. If the price breaks below this line, it suggests the uptrend may be over, and your trade idea is likely wrong.

- Stop Loss (for a Sell Trade): Place your stop loss just above the red resistance line. This line acts as a dynamic resistance. If the price breaks above it, the downtrend might be reversing.

- Take Profit: You have a few options for exiting with a profit:

- Opposite Signal: The simplest way is to exit your position when the indicator gives an opposite signal. For example, if you entered a buy trade on a “LONG” signal, you would close the position when the chart shows a “SHORT” signal. This allows you to ride the entire trend.

- Trailing Stop: Use the indicator’s line as a trailing stop. As the price moves in your favor, the line will move with it, protecting your gains. You would exit the trade only when the price crosses the line in the opposite direction.

- Fixed Risk/Reward: Set a predetermined profit target based on a ratio to your stop loss (e.g., aiming for a profit that’s two or three times your potential loss).

The uploaded image displays a trading chart for Gold with a trend-following indicator named “Range Filter Short Long.” The indicator simplifies trend identification by using a green line and “LONG” signals to indicate an uptrend and a red line with “SHORT” signals for a downtrend. A trader would enter a buy (long) trade when the line turns green and a sell (short) trade when it turns red. For risk management, a stop loss should be placed just below the green line for a buy trade or just above the red line for a sell trade. The trade can be exited for take profit when the indicator gives an opposite signal, acting as a trailing stop, or by using a fixed risk-to-reward ratio.

Be the first to review “Range Filter Short Long Indicator” Cancel reply

You must be logged in to post a review.

Related products

Tradingview

Tradingview

Tradingview

Tradingview

Tradingview

Tradingview

Tradingview

Tradingview

Reviews

There are no reviews yet.