Blog

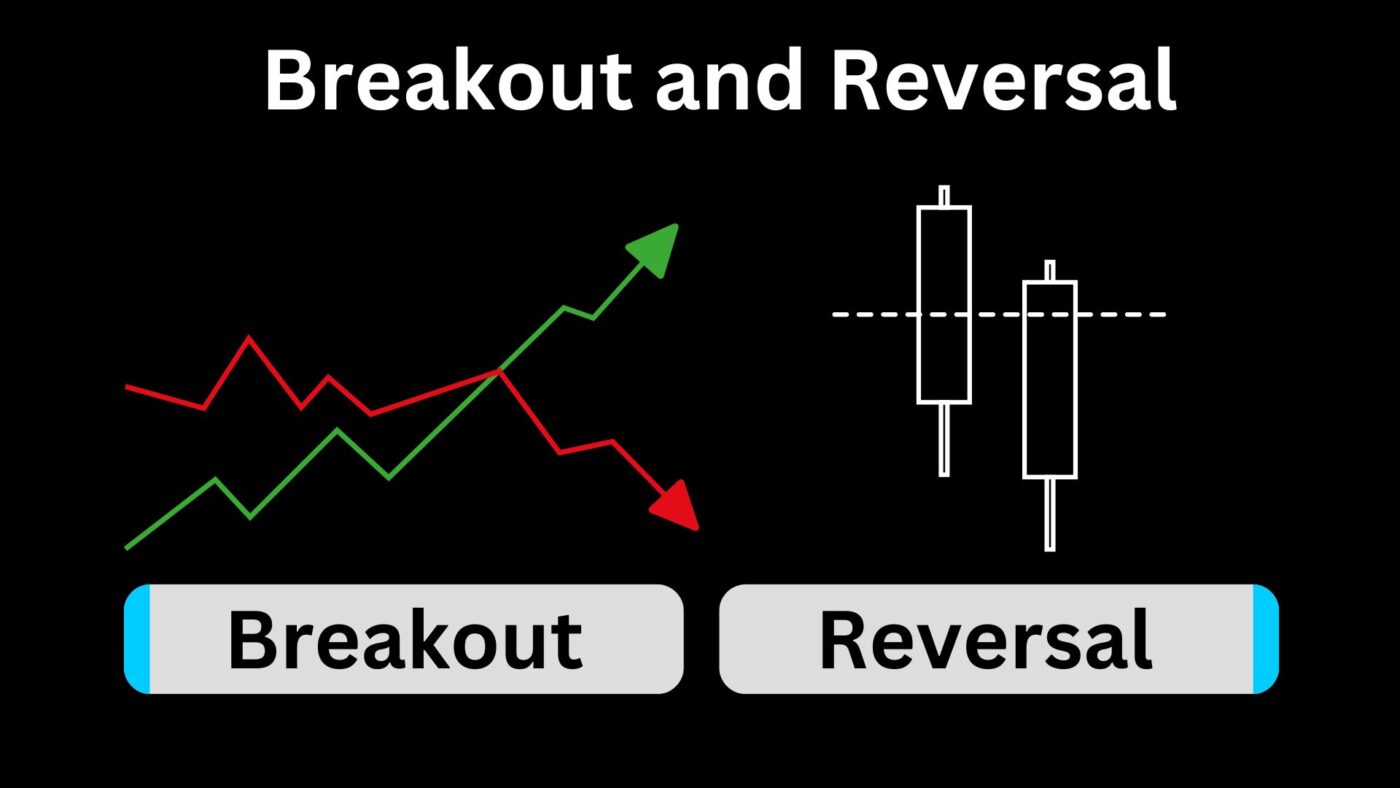

What is the difference between a breakout and a reversal in Forex trading?

In Forex trading, both “breakout” and “reversal” are terms used to describe specific price movements on a chart. They have distinct meanings and implications for traders. Let’s explore each concept:

- Breakout:

A breakout occurs when the price of a currency pair moves above a significant level of resistance or below a significant level of support. These levels are usually formed by previous price highs and lows, creating horizontal lines on the chart that act as barriers for the price movement. When the price breaks above resistance or below support, it signifies a potential shift in market sentiment, and traders expect the price to continue moving in the direction of the breakout.

- Bullish Breakout: A bullish breakout happens when the price moves above a resistance level, indicating potential upward momentum and a possibility of a new uptrend.

- Bearish Breakout: A bearish breakout occurs when the price moves below a support level, suggesting potential downward momentum and the likelihood of a new downtrend.

Traders often look for volume confirmation when identifying breakouts to ensure that the move has substantial market participation, which increases the reliability of the breakout signal.

- Reversal:

A reversal in Forex trading refers to a change in the direction of an existing trend. It happens when a prevailing uptrend shifts to a downtrend or vice versa. Reversals are significant turning points on the price chart and indicate potential changes in market sentiment.

- Bullish Reversal: A bullish reversal occurs when a downtrend changes into an uptrend. It suggests that a period of falling prices is coming to an end, and buyers are gaining control, leading to a potential upward movement in prices.

- Bearish Reversal: A bearish reversal happens when an uptrend changes into a downtrend. It indicates that a period of rising prices is ending, and sellers are gaining control, leading to a potential downward movement in prices.

Reversal signals are often identified through technical indicators or price patterns, such as head and shoulders, double tops/bottoms, and candlestick patterns like the engulfing pattern or doji.

In summary, a breakout refers to a price movement above resistance or below support levels, while a reversal signifies a change in the overall trend direction. Traders use different strategies and tools to identify and capitalize on these market situations. Both breakouts and reversals are essential concepts to understand for successful Forex trading.