Blog

How to calculate margin?

To calculate margin, you need to determine the margin requirement set by your broker and the total value of the trade. Here’s a step-by-step guide on how to calculate margin:

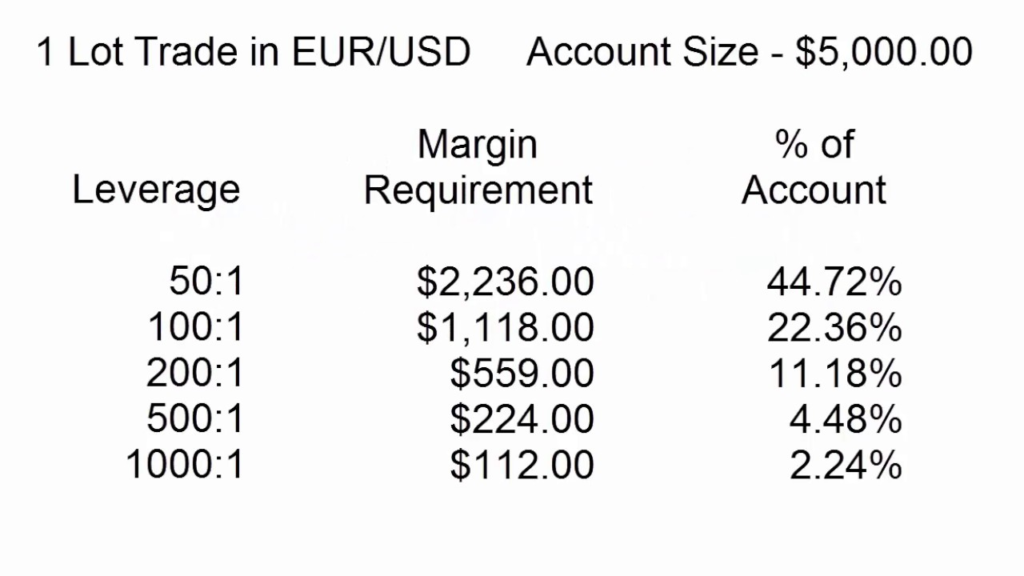

- Determine the Margin Requirement: The margin requirement is usually expressed as a percentage or a ratio, indicating the portion of the trade value that you need to have as margin. For example, if the margin requirement is 5%, you would need to have 5% of the total trade value as margin.

- Determine the Total Trade Value: Calculate the total value of your trade by multiplying the lot size (number of units) by the contract size and the current market price. The contract size is specific to the instrument you are trading. Total Trade Value = Lot Size * Contract Size * Market Price

- Calculate the Margin Required: Multiply the total trade value by the margin requirement expressed as a decimal. For example, if the margin requirement is 5% (0.05), the margin required would be: Margin Required = Total Trade Value * Margin Requirement

In this example, let’s assume you want to trade 2 lots of a currency pair with a contract size of 100,000 units per lot and a market price of $1.2000, and the margin requirement is 5%:

Total Trade Value = 2 lots * 100,000 units/lot * $1.2000 = $240,000

Margin Required = $240,000 * 0.05 = $12,000

In this example, you would need to have at least $12,000 in your trading account as margin to open and maintain the trade with a 5% margin requirement.

It’s important to note that margin requirements may vary depending on the broker and the specific instrument being traded. Always consult your broker’s guidelines and policies regarding margin requirements to ensure accurate calculations. Additionally, it’s crucial to manage your margin levels carefully and monitor your positions to avoid margin calls or excessive losses.