Subtotal: $289.00

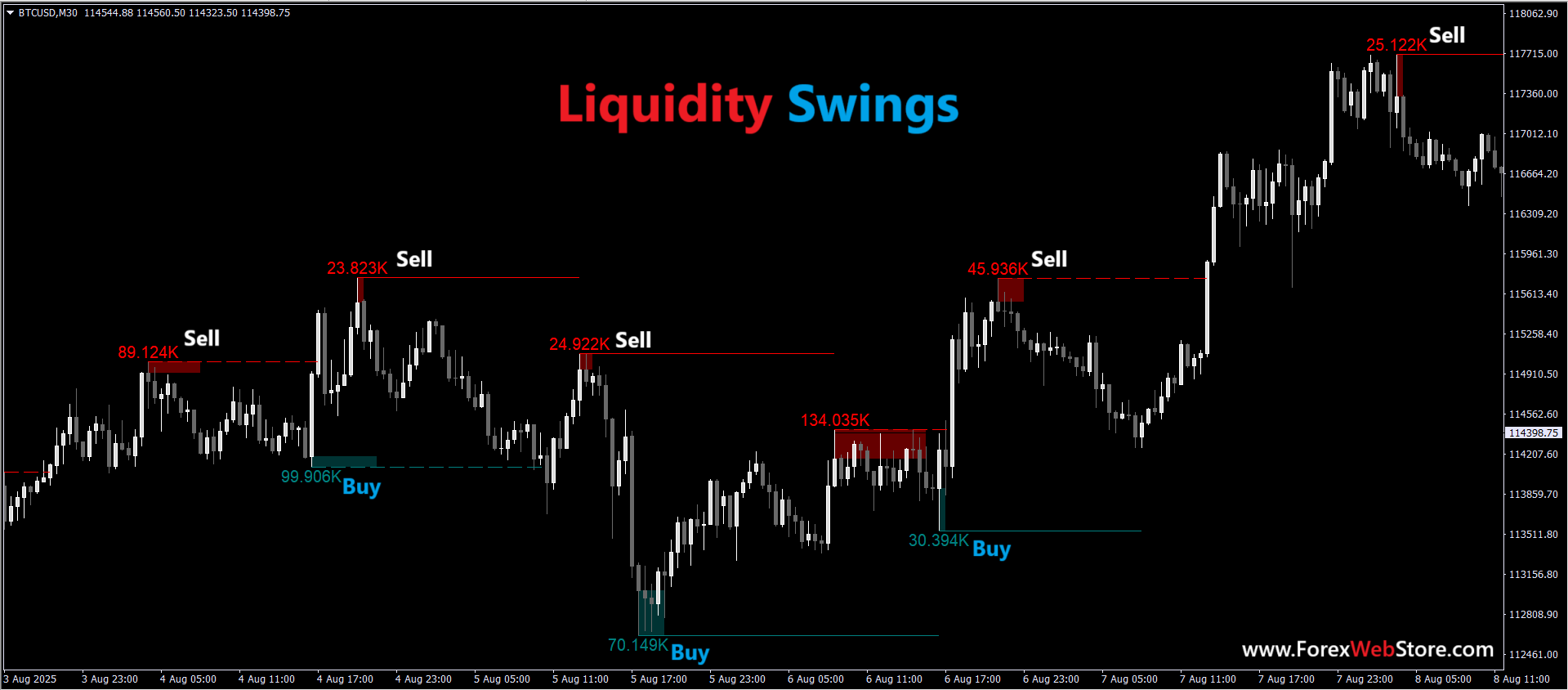

Liquidity Swings MT4 Indicator

$1,500.00 Original price was: $1,500.00.$195.00Current price is: $195.00.

- Original Indicator

- 100% Non-Repaint

- Trading time: Every time

- Instant Download in Zip file

- Arrows Popup Sound Alerts

- Timeframe: M15, M30, H1,H4,D1

- Never repaint any trading signal, 100% guaranteed

- Use on unlimited MT4 accounts

- Type of strategy: Powerful Scalping Indicator

- Built for Metatrader 4 (MT4 for PC and Laptop, MT4 for MAC)

- Works on Forex (all pairs), Commodities, Stocks, Metals, Gold…

- Recommended Broker ECN

- Pay Once and Use it for a Lifetime

- Customer Support & Free Upgrades For Life Time

Liquidity Swings MT4 Indicator

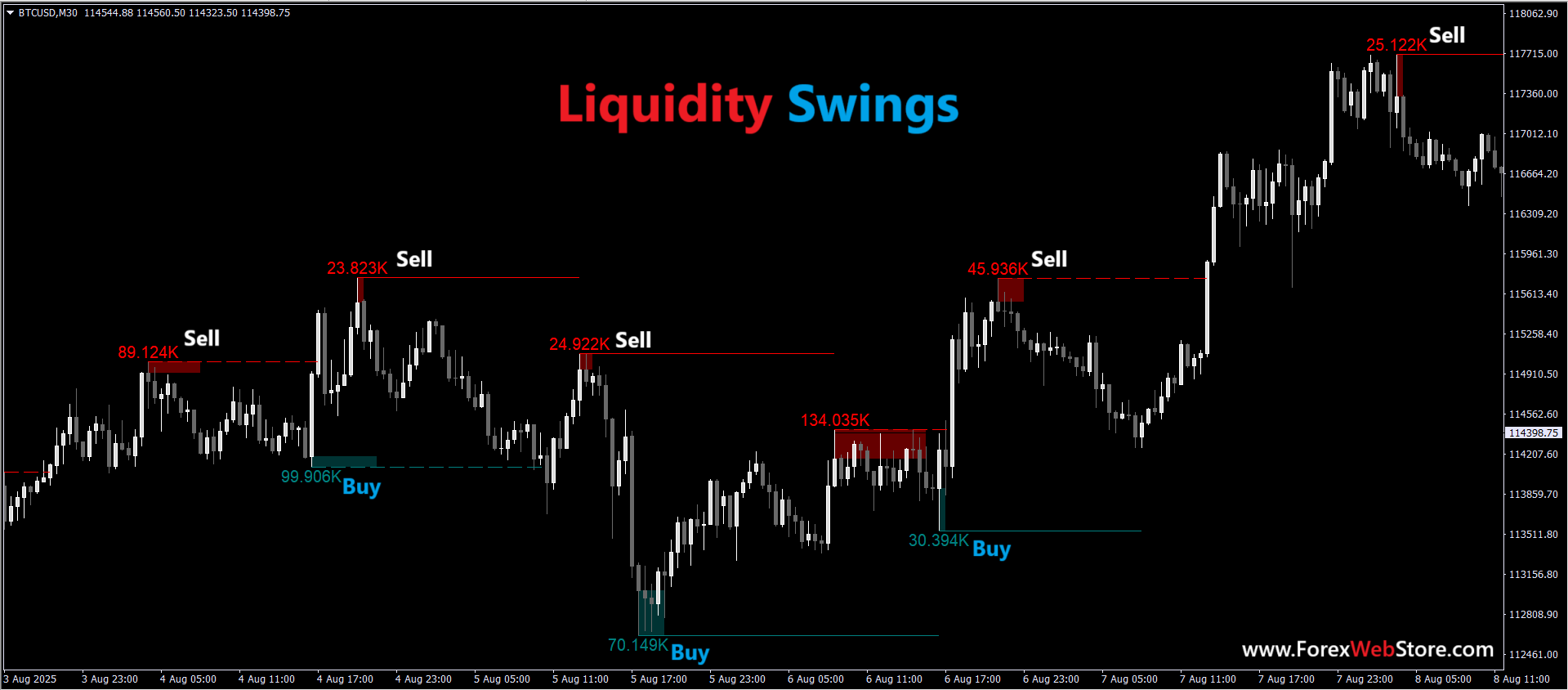

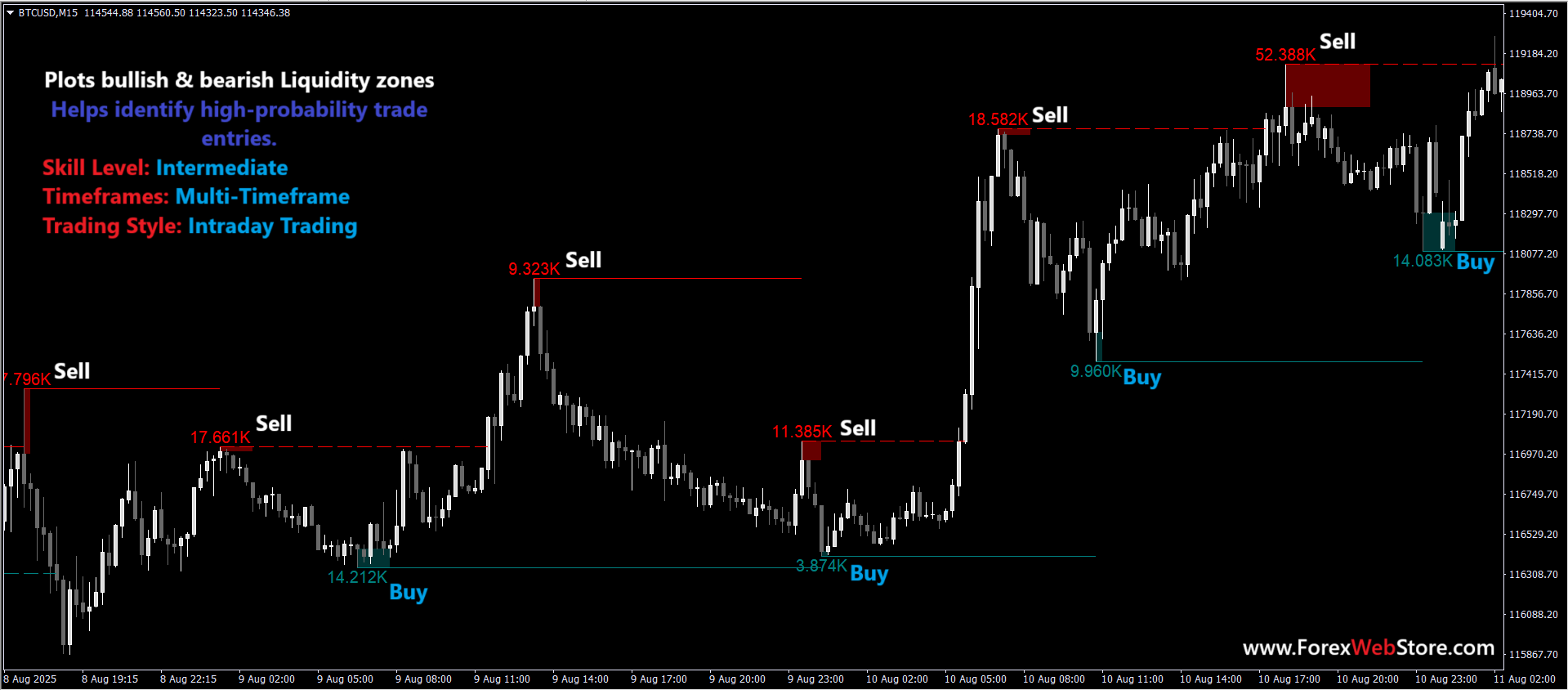

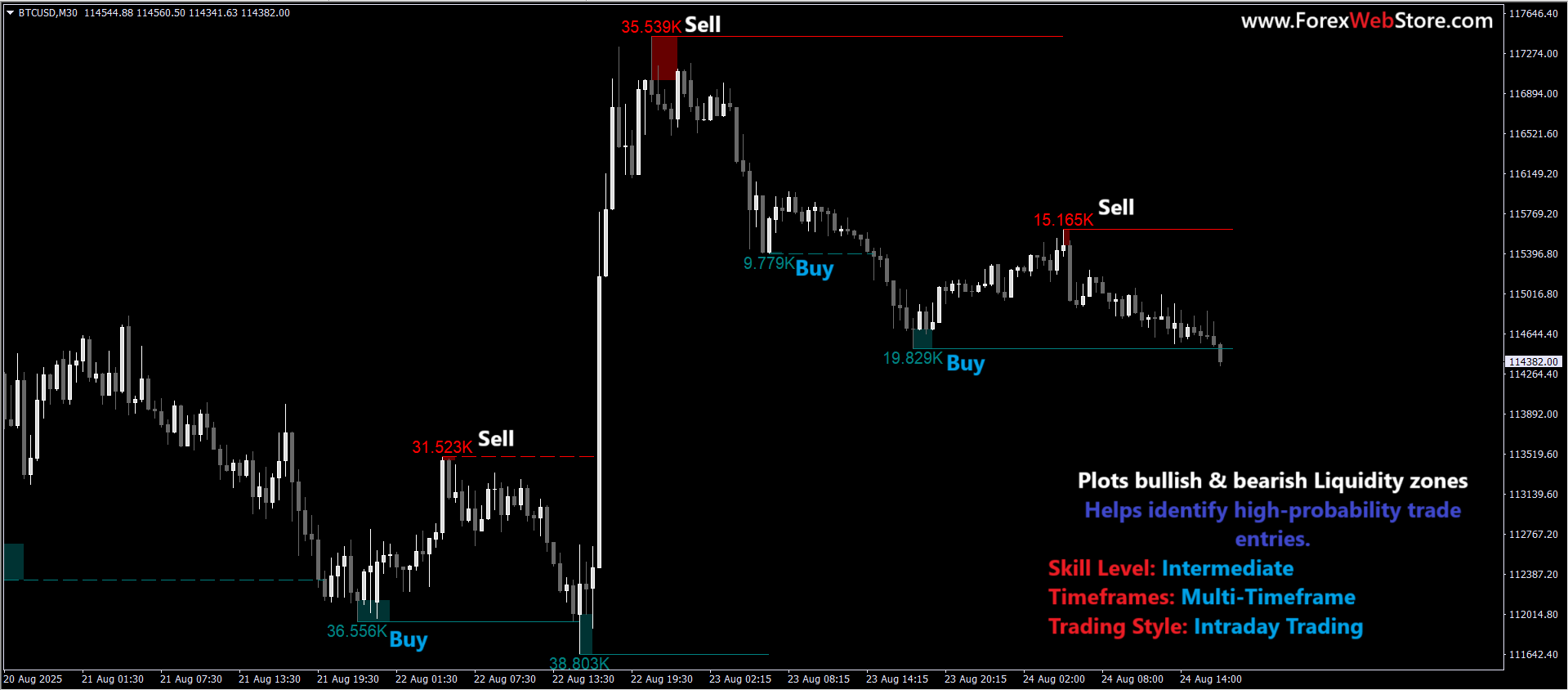

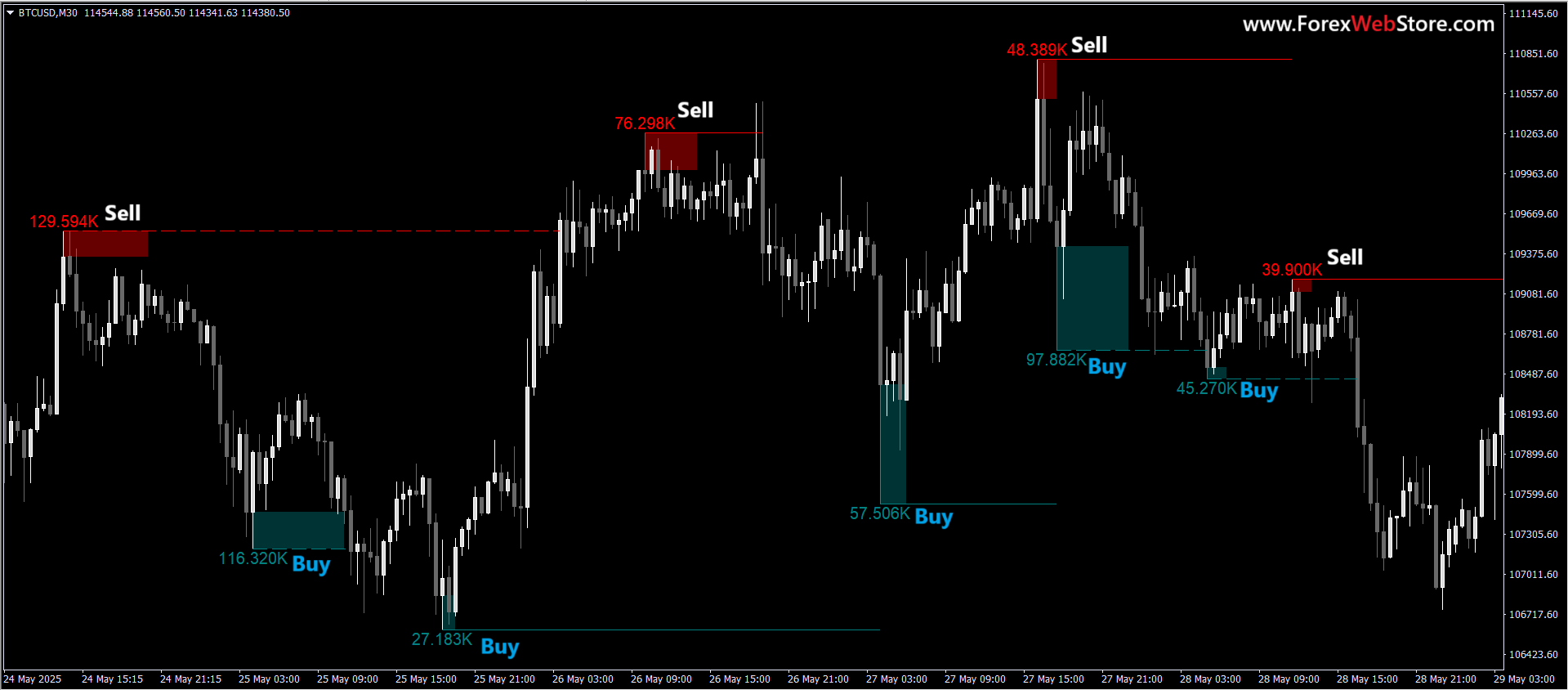

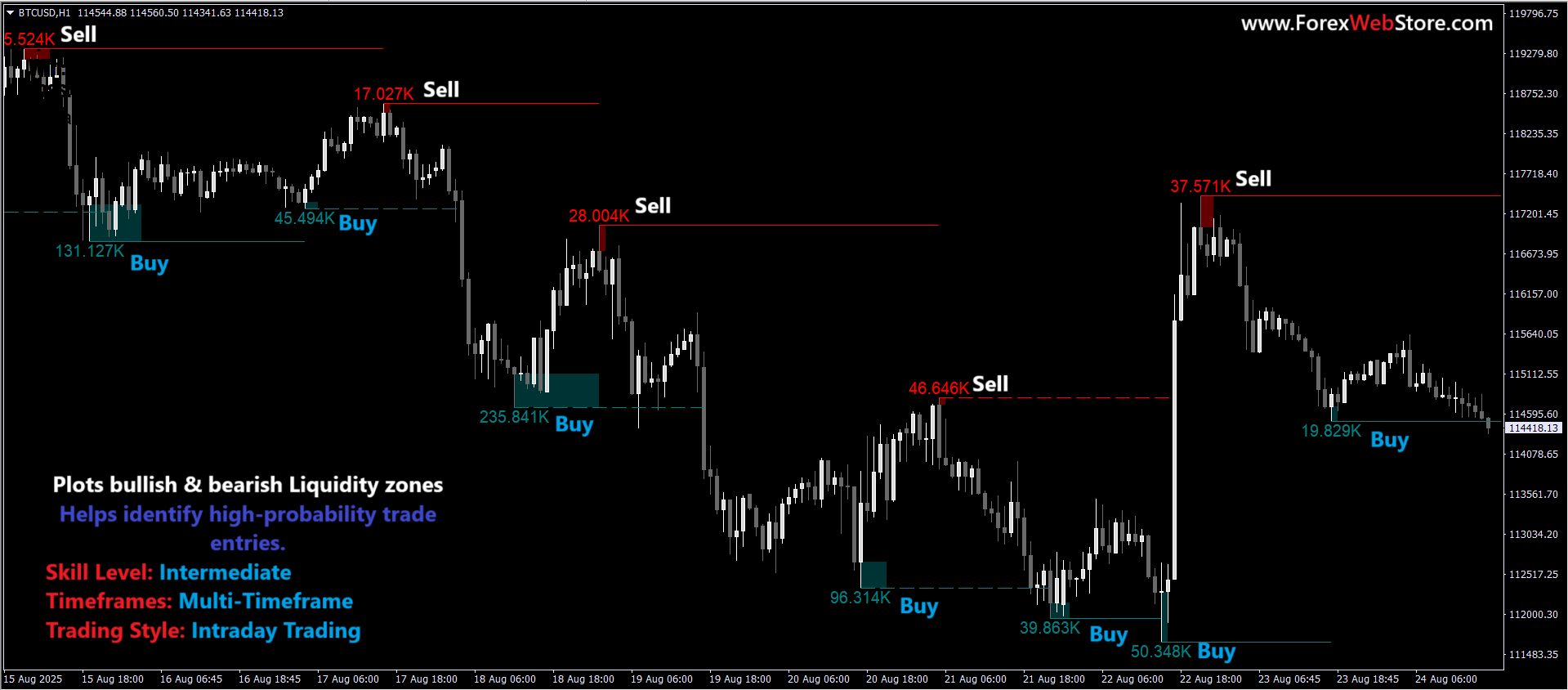

The image shows a trading framework based on Smart Money Concepts (SMC), specifically focusing on Buyside and Sellside Liquidity. This is not just a single indicator but a price action strategy used to identify where “Smart Money” (institutional traders) might enter the market by “sweeping” the stop losses of retail traders.

Understanding the Key Zones

-

Buyside Liquidity (BSL): These zones are located above old swing highs where short-sellers often place their buy-stop orders (stop losses).

-

Sellside Liquidity (SSL): These are areas below old swing lows where buyers typically place their sell-stop orders.

-

Liquidity Sweeps: This occurs when the price briefly moves past these zones to “grab” the orders before reversing sharply in the opposite direction.

What You Get for Your Metatrader 4:-

- Professional trading systems for all markets and time frames

- 100 Non-repainting and non-lagging indicators with dashboards

- Accurate buy and sell signals with arrows and alerts

- Dynamic take profit levels to maximize your gains Smart stop loss levels to protect your capital

- Buy/Sell Automatic Signals

- Pop-up alerts

- Sound alerts

- Email alerts

- Push notifications

- Quick and easy installation with user-friendly interface

- Exclusive access to our community support portal Interactive multilingual guides and tips with FAQs

- Free updates to new versions and features

- First-class support with quick responses

- Instant download after purchase

How to Take Entries

The strategy relies on waiting for the market to “trap” retail traders before moving with the true trend.

1. Sell Entry (Bearish Reversal)

-

Setup: Identify a clear swing high (Buyside Liquidity).

-

Trigger: Wait for the price to wick above this high and then quickly close back below it, showing a sharp rejection.

-

Confirmation: Look for a Market Structure Shift (MSS) on a lower timeframe (e.g., M5 if using H1) to confirm the reversal.

-

Execution: Enter a “Sell” position at the close of the reversal candle or on a retest of a nearby Fair Value Gap (FVG).

2. Buy Entry (Bullish Reversal)

-

Setup: Identify a clear swing low (Sellside Liquidity).

-

Trigger: Price must dip below the low to “sweep” liquidity and then snap back above the level.

-

Confirmation: A bullish engulfing candle or a shift in structure on a lower timeframe confirms institutional buying.

-

Execution: Enter a “Buy” position once the price stabilizes above the previous low.

The input signals I use are:

- The price if it takes liquidity from PDH, I wait for Open London Manipulation above the Asian session. When the price re-enters the Asian session on the downside, I make my entry. My favorite system is when, in addition.

- The same happens in the opposite case for longs.

- My SL is above the maximum or minimum.

- The great advantage of this strategy is the risk benefit ratio it offers.

- I use 15-30 minute charts and intraday trading.

Stop Loss & Risk Management

Trading liquidity requires discipline, as you are entering when the market looks most volatile.

| Component | Guideline | Implementation Tip |

| Stop Loss (SL) | Place SL just beyond the wick of the “sweep” candle. | Add a small buffer (e.g., 2–5 pips) to avoid being tagged by spread. |

| Take Profit (TP) | Target the opposite liquidity pool. | If buying at SSL, target the nearest prominent swing high (BSL). |

| Risk-to-Reward | Minimum 1:2 or 1:3 ratio. | Because your SL is tight, these trades often offer high reward potential. |

| Position Sizing | Risk 1% to 2% per trade. | Never over-leverage; even high-probability sweeps can fail if the trend is too strong. |

The indicator visually marks two key types of zones: Buyside Liquidity (typically above highs) and Sellside Liquidity (below lows). These zones suggest where stop-loss orders, breakout traders, or trapped positions might accumulate. When price approaches or sweeps these areas, it often signals potential reversals, fakeouts, or momentum breakouts.

Traders can use this to:

- Anticipate potential price reversals at liquidity grabs

- Identify areas of liquidity inducement

- Align entries and exits with institutional footprints

- Avoid entering near obvious retail stop zones

Category: ICT – Liquidity – Smart Money

![]() Platform: MetaTrader 4 (MT4)

Platform: MetaTrader 4 (MT4)

![]() Skill Level: Intermediate

Skill Level: Intermediate

![]() Indicator Type: Reversal – Continuation

Indicator Type: Reversal – Continuation

![]() Timeframes: Multi-Timeframe

Timeframes: Multi-Timeframe

![]() Markets: Forex, Crypto, Stocks, Commodities

Markets: Forex, Crypto, Stocks, Commodities

![]() Trading Style: Intraday Trading

Trading Style: Intraday Trading

![]() Helps traders refine ICT-based trading strategies

Helps traders refine ICT-based trading strategies

Strategy Optimization

-

Timeframes: Use the 1-Hour (H1) or 4-Hour (H4) for the main zones and the 5-Minute (M5) for precise entry timing.

-

Kill Zones: High-probability setups usually occur during the London or New York session opens when volume is highest.

Thank You

Be the first to review “Liquidity Swings MT4 Indicator” Cancel reply

You must be logged in to post a review.

Related products

-70%

Rated 4.5 out of 5

-68%

-75%

Rated 5 out of 5

-71%

-80%

Rated 5 out of 5

-71%

Rated 4 out of 5

-71%

Rated 4 out of 5

-67%

Super Nifty 50 MT4 Indicator | 100% Non Repaint Indicator V24.0

Super Nifty 50 MT4 Indicator | 100% Non Repaint Indicator V24.0

Reviews

There are no reviews yet.