Blog

What is 5% margin in forex?

A 5% margin in forex means that you need to have 5% of the total trade value as margin in your trading account to open and maintain a position. It is the minimum collateral or deposit required by your broker.

To calculate the margin amount, you can follow these steps:

- Determine the Total Trade Value: Calculate the total value of your trade by multiplying the lot size (number of units) by the current exchange rate.

- Calculate the Margin Required: Multiply the total trade value by the margin requirement expressed as a decimal. In this case, the margin requirement is 5%, so you would multiply the total trade value by 0.05.

Here’s an example to illustrate:

Let’s say you want to trade 1 lot (100,000 units) of a currency pair with an exchange rate of 1.3000.

Total Trade Value = Lot Size * Exchange Rate

Total Trade Value = 100,000 * 1.3000 = $130,000

Margin Required = Total Trade Value * Margin Requirement

Margin Required = $130,000 * 0.05 = $6,500

In this example, you would need to have at least $6,500 in your trading account as margin to open and maintain the trade with a 5% margin requirement.

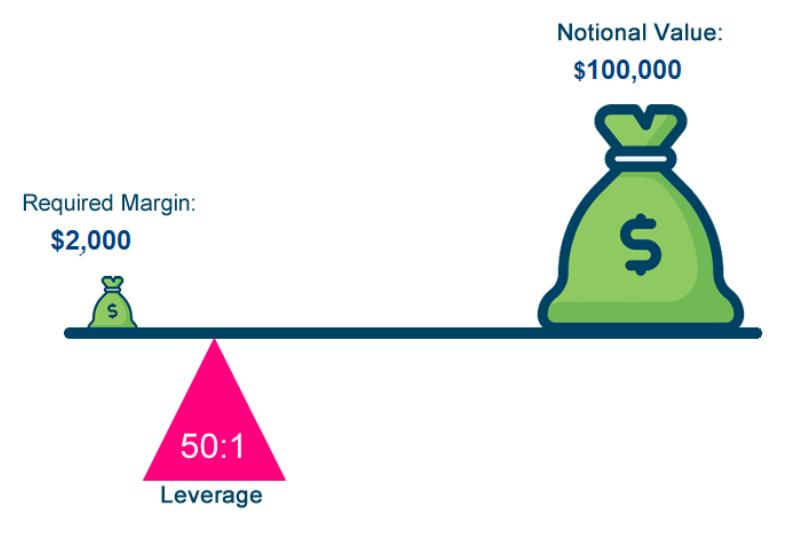

It’s important to note that margin trading amplifies both potential profits and losses. While leverage allows traders to control larger positions with a smaller amount of capital, it also increases the risk. Proper risk management is crucial to protect your account balance and avoid margin calls or excessive losses.