Free Indicator

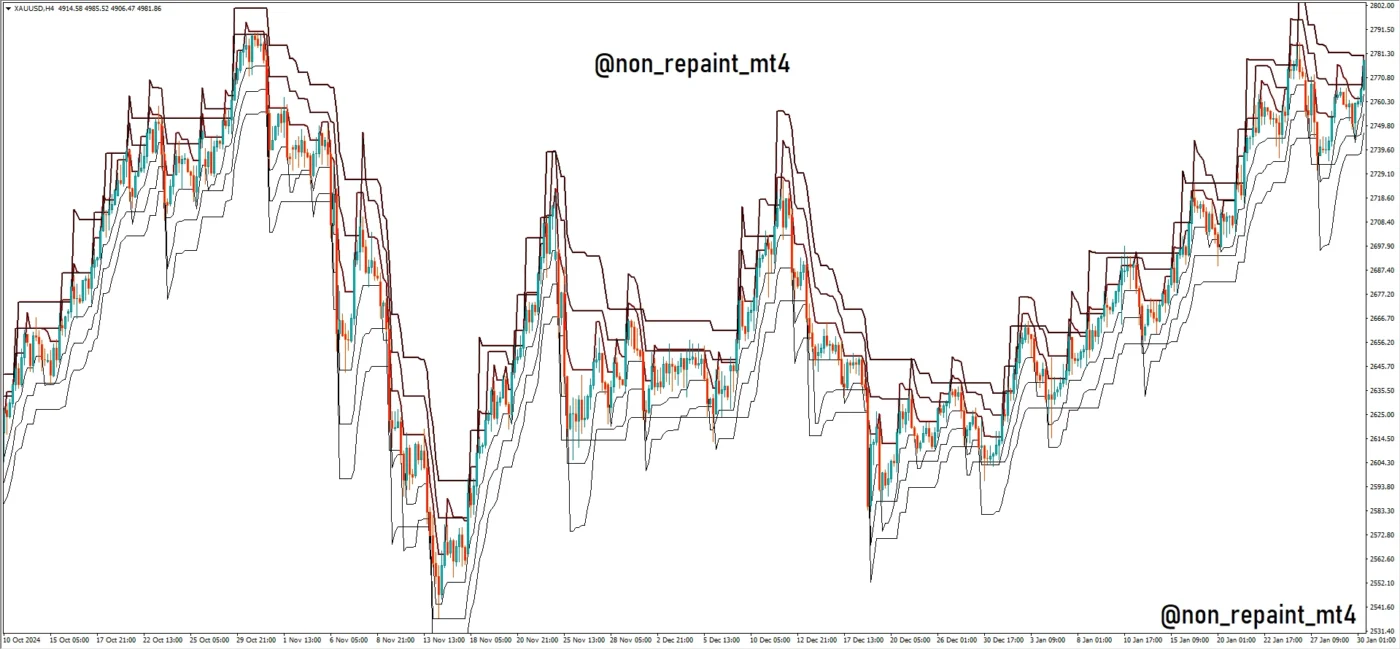

channel / volatility band + trailing box type indicator.

You are using a channel / volatility band + trailing box type indicator (looks like dynamic upper-lower bands with red breakout levels). I will explain a clear rule-based system you can follow with proper Entry, Stop Loss, Take Profit, and 1:2 Risk:Reward.

I will keep it simple and professional.

✅ 1. Trend Direction Rule (Very Important)

First identify trend:

- 🔵 If price is above middle band and bands are expanding → BUY trend

- 🔴 If price is below middle band and bands are expanding → SELL trend

- ⚠️ If bands are flat and tight → Avoid trading (sideways market)

Only trade in trending conditions.

✅ 2. Entry Rules

🔵 BUY Entry

Enter BUY when:

- Price closes above red upper breakout line

- Candle closes outside upper band

- Bands are expanding upward

👉 Entry = At next candle open

🔴 SELL Entry

Enter SELL when:

- Price closes below lower red breakout line

- Candle closes outside lower band

- Bands expanding downward

👉 Entry = At next candle open

✅ 3. Stop Loss Placement (Very Important)

Use structure-based SL.

For BUY:

- Stop Loss = Below last swing low

OR - Below lower band

For SELL:

- Stop Loss = Above last swing high

OR - Above upper band

Never use random SL.

✅ 4. Take Profit (1:2 Risk Reward Strategy)

Use fixed Risk:Reward ratio.

Example:

If Stop Loss = 50 pips

Then Take Profit = 100 pips

👉 Always maintain minimum 1:2 RR

Formula:

Risk = Entry – Stop Loss

TP = Entry + (Risk × 2) for BUY

TP = Entry – (Risk × 2) for SELL

✅ 5. Advanced TP Option (Trailing Method)

You can also:

- Trail SL to middle band

- Or trail below/above opposite band

- Or close when candle closes inside band again

This locks profits in strong trends.

✅ 6. Risk Management (Very Important)

Never risk more than:

- 1% per trade (safe)

- 2% maximum (aggressive)

Lot size formula:

Lot Size = (Account Balance × Risk %) ÷ Stop Loss (in pips)

Example:

$1000 account

1% risk = $10

SL = 50 pips

Lot size = $10 ÷ 50 = 0.20 mini lot (approx depending on pair)

✅ 7. Best Pairs for This Indicator

Works best in:

- XAUUSD (Gold)

- GBPJPY

- NAS100

- EURUSD (during London/NY session)

Avoid:

- Low volatility Asian session

- News time (high spike fake breakouts)

✅ 8. Common Mistakes to Avoid

❌ Don’t trade when bands flat

❌ Don’t trade against trend

❌ Don’t remove SL

❌ Don’t overtrade

✅ Complete Example (Gold – XAUUSD)

Price breaks upper band

Entry = 4975

SL = 4965 (10$ risk)

TP = 4995 (1:2 = 20$ target)

Simple. Mechanical. No emotions.

Download File Click Here ❤️