Free Indicator

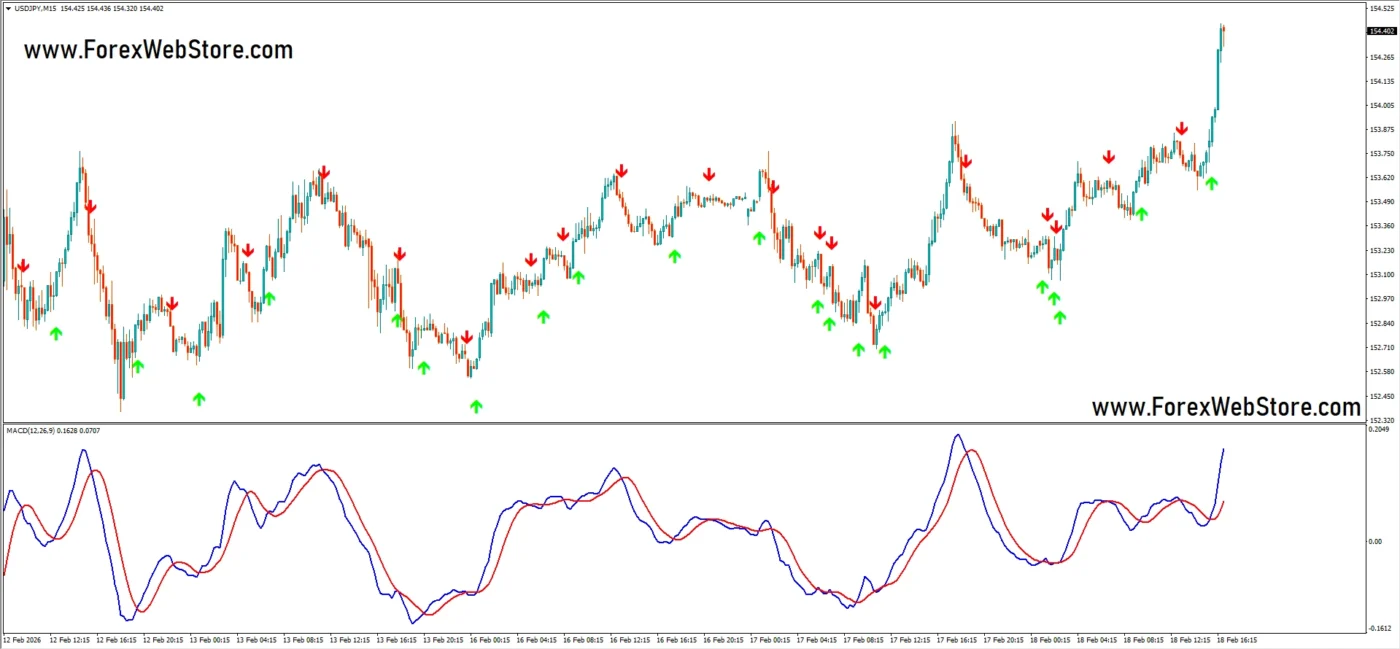

Buy/Sell Arrow Signal system with MACD confirmation.

This indicator is a Buy/Sell Arrow Signal system with MACD confirmation (trend + momentum combination).

I’ll give you a clear mechanical strategy with:

- Entry

- Stop Loss

- Take Profit

- 1:2 Risk Reward

- Risk Management

No confusion. Simple rules.

✅ 1️⃣ Trend Confirmation (Very Important)

Before taking any arrow signal:

🔵 Buy Only If:

- MACD blue line is above red line

- Both lines are above 0 level (strong trend)

- Market structure showing higher highs & higher lows

🔴 Sell Only If:

- MACD blue line below red line

- Both lines below 0 level

- Lower highs & lower lows forming

Avoid taking signals against MACD direction.

✅ 2️⃣ Entry Rules

🔵 BUY Entry

Enter when:

- Green arrow appears

- MACD confirms bullish crossover

- Candle closes bullish

👉 Entry at next candle open.

🔴 SELL Entry

Enter when:

- Red arrow appears

- MACD confirms bearish crossover

- Candle closes bearish

👉 Entry at next candle open.

✅ 3️⃣ Stop Loss Placement

Never use random SL.

For BUY:

- Stop Loss below recent swing low

OR - 5–10 pips below arrow candle low (M15 timeframe)

For SELL:

- Stop Loss above recent swing high

OR - 5–10 pips above arrow candle high

Structure-based SL is safest.

✅ 4️⃣ Take Profit (1:2 Risk Reward Strategy)

Always maintain minimum 1:2 RR.

Example:

If SL = 20 pips

TP = 40 pips

Formula:

Risk = Entry – SL

For BUY:

TP = Entry + (Risk × 2)

For SELL:

TP = Entry – (Risk × 2)

✅ 5️⃣ Trailing Stop Option (Advanced)

When price moves 1R (same as SL distance):

- Move SL to breakeven

- Trail below recent swing low (for buy)

- Trail above swing high (for sell)

This increases profitability in strong trends.

✅ 6️⃣ Risk Management (Very Important)

Never risk more than:

- 1% per trade (recommended)

- 2% maximum

Lot Size Formula:

Lot Size = (Account Balance × Risk %) ÷ Stop Loss (pips value)

Example:

$1000 account

1% risk = $10

SL = 20 pips

Position size = Risk ÷ SL

✅ 7️⃣ Best Conditions for This Indicator

Works best:

- M15 timeframe

- London session

- New York session

- Trending pairs (GBPJPY, XAUUSD, NAS100, USDJPY)

Avoid:

- Sideways market

- Before high impact news

- When MACD flat around zero

✅ 8️⃣ Win Rate Improvement Trick

Only take:

- Arrow + MACD crossover

- Arrow in direction of overall trend

- Arrow after pullback

Skip early arrows in ranging zones.

🔥 Example on Your Chart (USDJPY M15)

Green arrow → MACD bullish →

Entry: 153.200

SL: 153.050 (15 pips risk)

TP: 153.500 (30 pips target = 1:2 RR)

Simple. Controlled. Professional.