Here’s a comprehensive and detailed breakdown of tools and indicators used in Forex trading, This document includes technical analysis tools, charting platforms, indicators (leading and lagging), and practical strategies for application. Tools and Indicators Used with Forex Charts Introduction The foreign exchange (Forex) market is the largest and most liquid financial market globally, with trillions […]

Tag Archives: forex trading

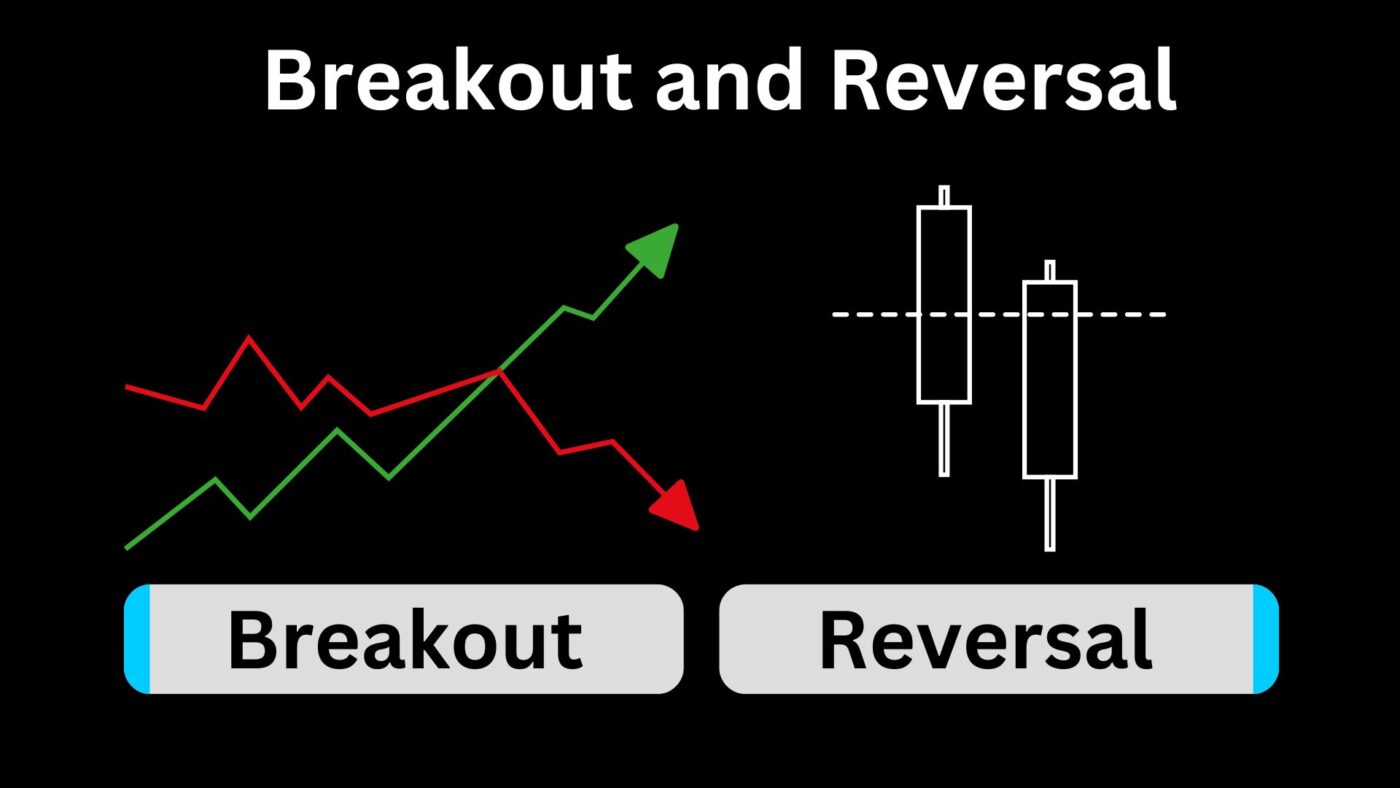

In Forex trading, both “breakout” and “reversal” are terms used to describe specific price movements on a chart. They have distinct meanings and implications for traders. Let’s explore each concept: Traders often look for volume confirmation when identifying breakouts to ensure that the move has substantial market participation, which increases the reliability of the breakout […]

The choice of the “best” forex chart depends on the preferences and trading style of the individual trader. Different types of forex charts offer different advantages and may be better suited for specific trading strategies. Here are some commonly used forex charts and their characteristics: Ultimately, the best chart type depends on your trading strategy, […]

A 5% margin in forex means that you need to have 5% of the total trade value as margin in your trading account to open and maintain a position. It is the minimum collateral or deposit required by your broker. To calculate the margin amount, you can follow these steps: Here’s an example to illustrate: […]

Volatility in forex refers to the degree of variation or fluctuation in the price of a currency pair over a specific period. It measures the rate at which the price of a currency pair moves up and down, indicating the potential for price changes and market uncertainty. Volatility is a key characteristic of the forex […]

Hedging in forex refers to a risk management strategy used by traders and investors to minimize or offset potential losses from adverse price movements in the currency markets. It involves taking opposite positions in related instruments to protect against unfavorable market conditions. The primary purpose of hedging is to reduce or eliminate the impact of […]

Indicators can be valuable tools in forex trading, but it’s important to understand their limitations and use them appropriately. Here are some key points to consider: Ultimately, successful forex trading requires a comprehensive approach that includes a combination of technical analysis, fundamental analysis, risk management, and market experience. While indicators can be helpful in analyzing […]

To open a MetaTrader 4 (MT4) account, you will need to follow these steps: Once your account is funded, you can start trading on MT4.